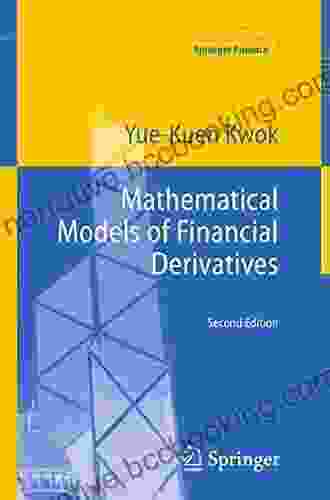

Mathematical Models of Financial Derivatives: A Comprehensive Guide for Practitioners and Researchers

Financial derivatives are complex financial instruments that are used to manage risk and speculate on the future value of assets. The mathematical models used to price and risk-manage financial derivatives are complex and require a deep understanding of mathematics.

4.7 out of 5

| Language | : | English |

| File size | : | 11923 KB |

| Screen Reader | : | Supported |

| Print length | : | 386 pages |

This book provides a comprehensive overview of the mathematical models used to price and risk-manage financial derivatives. It is written for practitioners and researchers who need a deep understanding of the underlying mathematics.

Table of Contents

- Forward Contracts

- Futures Contracts

- Options Contracts

- Swaps

- Credit Derivatives

- Risk Management

- s

Financial derivatives are financial instruments that derive their value from the value of an underlying asset, such as a stock, bond, or commodity. Financial derivatives are used to manage risk and speculate on the future value of assets.

The mathematical models used to price and risk-manage financial derivatives are complex and require a deep understanding of mathematics. This book provides a comprehensive overview of the mathematical models used to price and risk-manage financial derivatives.

Forward Contracts

Forward contracts are agreements to buy or sell an asset at a specified price on a specified date in the future. Forward contracts are used to lock in a price for an asset, which can be useful for managing risk or speculating on the future value of the asset.

The mathematical model used to price forward contracts is the Black-Scholes model. The Black-Scholes model is a stochastic differential equation that describes the evolution of the price of an asset over time. The Black-Scholes model can be used to price forward contracts for a variety of underlying assets, including stocks, bonds, and commodities.

Futures Contracts

Futures contracts are similar to forward contracts, but they are traded on an exchange. Futures contracts are standardized contracts that have a specified size and expiration date. Futures contracts are used to manage risk and speculate on the future value of an asset.

The mathematical model used to price futures contracts is the same as the mathematical model used to price forward contracts. The Black-Scholes model can be used to price futures contracts for a variety of underlying assets, including stocks, bonds, and commodities.

Options Contracts

Options contracts are agreements that give the buyer the right, but not the obligation, to buy or sell an asset at a specified price on a specified date in the future. Options contracts are used to manage risk and speculate on the future value of an asset.

The mathematical model used to price options contracts is the Black-Scholes model. The Black-Scholes model is a stochastic differential equation that describes the evolution of the price of an asset over time. The Black-Scholes model can be used to price options contracts for a variety of underlying assets, including stocks, bonds, and commodities.

Swaps

Swaps are agreements to exchange cash flows between two parties at specified intervals. Swaps are used to manage risk and speculate on the future value of interest rates or other financial instruments.

The mathematical model used to price swaps is the LIBOR market model. The LIBOR market model is a stochastic differential equation that describes the evolution of the LIBOR interest rate over time. The LIBOR market model can be used to price swaps for a variety of maturities and currencies.

Credit Derivatives

Credit derivatives are agreements that protect the buyer from the risk of default by a third party. Credit derivatives are used to manage risk and speculate on the creditworthiness of companies or governments.

The mathematical model used to price credit derivatives is the Merton model. The Merton model is a structural credit risk model that describes the probability of default of a company or government. The Merton model can be used to price credit derivatives for a variety of credit ratings and maturities.

Risk Management

Financial derivatives can be used to manage risk. Financial derivatives can be used to hedge against the risk of price fluctuations, interest rate fluctuations, or credit risk. Financial derivatives can also be used to speculate on the future value of assets.

The mathematical models used to price and risk-manage financial derivatives are essential for understanding the risk and return of financial

4.7 out of 5

| Language | : | English |

| File size | : | 11923 KB |

| Screen Reader | : | Supported |

| Print length | : | 386 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Christopher Dickey

Christopher Dickey Cheryl Burke

Cheryl Burke Charles W Calhoun

Charles W Calhoun Chloe Gong

Chloe Gong Cheryl Willis Hudson

Cheryl Willis Hudson Cathy Erway

Cathy Erway Christina Diehl

Christina Diehl Chelsea Hanson

Chelsea Hanson Chris Bowers

Chris Bowers Chenxin Jiang

Chenxin Jiang Choyo Wilson Daniel

Choyo Wilson Daniel Christopher Gillberg

Christopher Gillberg Chris Hauty

Chris Hauty Chester Nez

Chester Nez Christina Bennett

Christina Bennett Charodan

Charodan Christina Lamb

Christina Lamb Charles R Garoian

Charles R Garoian Cathy Glass

Cathy Glass Christopher Marlowe

Christopher Marlowe

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

William ShakespeareFollow ·6.1k

William ShakespeareFollow ·6.1k Allen ParkerFollow ·13.8k

Allen ParkerFollow ·13.8k Ethan MitchellFollow ·2.8k

Ethan MitchellFollow ·2.8k Graham BlairFollow ·6.7k

Graham BlairFollow ·6.7k Leo TolstoyFollow ·2.3k

Leo TolstoyFollow ·2.3k Harvey HughesFollow ·19.1k

Harvey HughesFollow ·19.1k Dion ReedFollow ·11.9k

Dion ReedFollow ·11.9k Matt ReedFollow ·11k

Matt ReedFollow ·11k

J.R.R. Tolkien

J.R.R. TolkienEscape to the Culinary Paradise: "Truck Stop Deluxe In...

Prepare your palate for an...

Andres Carter

Andres CarterA Taste of the Unusual: Discover the Enchanting World of...

Prepare to be captivated by "Cindy Supper...

Nick Turner

Nick TurnerChild Obesity: Introducing the Idea of Healthy Weight

Child obesity is a serious...

Junot Díaz

Junot DíazGoing Local: Your Ultimate Guide to Swiss Schooling |...

In the heart of Europe, Switzerland boasts a...

Raymond Parker

Raymond ParkerSir Cumference and the Dragon of Pi: A Mathematical Fable

In the enchanting realm of...

Thomas Powell

Thomas PowellUnveiling the Enchanting Realm of Curious Creatures from...

Russian folklore is a rich tapestry of...

4.7 out of 5

| Language | : | English |

| File size | : | 11923 KB |

| Screen Reader | : | Supported |

| Print length | : | 386 pages |