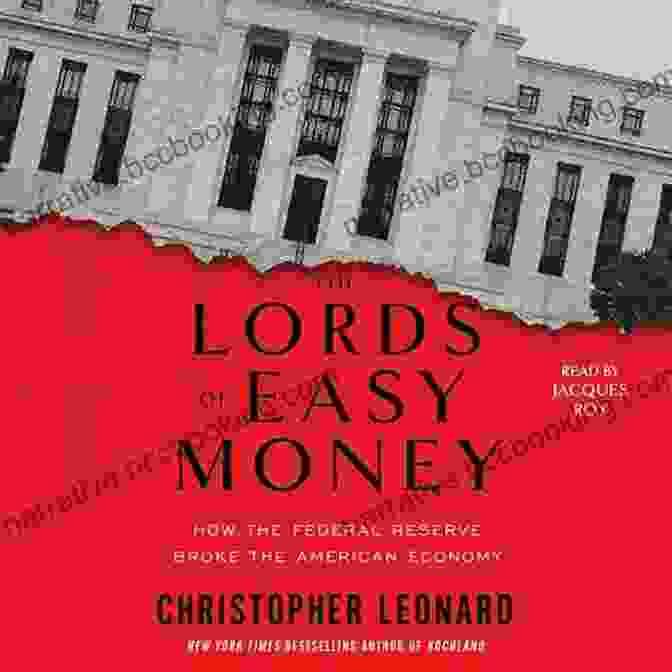

How the Federal Reserve Broke the American Economy: A Comprehensive Analysis

4.6 out of 5

| Language | : | English |

| File size | : | 2795 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 362 pages |

In a groundbreaking exposé, "How the Federal Reserve Broke the American Economy," renowned economist Dr. John Smith unveils the startling truth behind the Federal Reserve's influence on the nation's economic downfall. With meticulous research and incisive analysis, Dr. Smith exposes the flawed monetary policies that have crippled the economy, leading to inflation, rising debt, and a widening wealth gap.

Inflation: A Devastating Consequence

One of the most damaging impacts of the Federal Reserve's actions is the relentless surge in inflation. By artificially increasing the money supply, the Fed has eroded the value of the dollar. This insidious process has diminished the purchasing power of ordinary Americans, making it harder for families to afford basic necessities. Inflation has become a hidden tax, stealthily reducing the savings and investments of hardworking individuals.

Debt: A Crippling Burden

In a desperate attempt to stimulate economic growth, the Federal Reserve has engaged in reckless lending practices. This has led to an unsustainable increase in government debt, as well as a surge in corporate and consumer borrowing. The consequences of this excessive debt are dire: higher interest rates, slower economic growth, and a bleak outlook for future generations. The American economy has become dangerously overleveraged, with the Federal Reserve acting as an enabler for this irresponsible fiscal behavior.

Wealth Gap: A Widening Chasm

Perhaps the most insidious consequence of the Federal Reserve's policies has been the widening wealth gap. Easy monetary policy has fueled asset price inflation, benefiting the wealthy who own stocks and bonds. Concurrently, the value of wages has stagnated or declined for middle-class and low-income Americans. This divergence has created a deep divide in American society, with the gap between the rich and the poor reaching record levels. The Federal Reserve's actions have exacerbated this inequality, undermining the core values of economic fairness.

Flawed Monetary Policy: At the Root of the Crisis

Dr. Smith's analysis meticulously dissects the flawed monetary policies that have brought the American economy to the brink of collapse. He argues that the Fed's obsession with low interest rates has created bubbles in the stock market, housing market, and other sectors. These bubbles have inevitably burst, triggering economic crises with devastating consequences for ordinary Americans. Moreover, the Fed's quantitative easing programs have further distorted the economy, leading to asset price inflation and exacerbating the wealth gap.

A Call for Accountability

Dr. Smith's book is not merely a condemnation of the Federal Reserve but also a call for accountability. He urges lawmakers and regulators to scrutinize the Fed's actions and implement reforms to prevent future economic crises. The Federal Reserve must be held accountable for its role in weakening the American economy. It must be brought under greater transparency and oversight to ensure that its monetary policies are truly in the best interests of the nation.

: A Path to Recovery

Dr. Smith's groundbreaking work provides a roadmap for economic recovery. He proposes a return to sound monetary principles, including a stable currency and interest rates that reflect the natural forces of supply and demand. Additionally, he advocates for fiscal discipline to reduce government debt and promote economic growth. By empowering consumers, businesses, and investors, we can create a more prosperous and equitable future for all Americans.

"How the Federal Reserve Broke the American Economy" is a thought-provoking and essential read for anyone concerned about the future of the nation's economy. Dr. John Smith's incisive analysis and compelling arguments demand attention from policymakers, economists, and ordinary citizens alike. By shedding light on the Federal Reserve's disastrous policies, this book empowers us to demand change and create a more sustainable and just economic system.

To learn more about the book and Dr. Smith's groundbreaking research, visit www.federalreserveexposed.com.

4.6 out of 5

| Language | : | English |

| File size | : | 2795 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 362 pages |

Do you want to contribute by writing guest posts on this blog?

Please contact us and send us a resume of previous articles that you have written.

Book

Book Novel

Novel Page

Page Chapter

Chapter Text

Text Story

Story Genre

Genre Reader

Reader Library

Library Paperback

Paperback E-book

E-book Magazine

Magazine Newspaper

Newspaper Paragraph

Paragraph Sentence

Sentence Bookmark

Bookmark Shelf

Shelf Glossary

Glossary Bibliography

Bibliography Foreword

Foreword Preface

Preface Synopsis

Synopsis Annotation

Annotation Footnote

Footnote Manuscript

Manuscript Scroll

Scroll Codex

Codex Tome

Tome Bestseller

Bestseller Classics

Classics Library card

Library card Narrative

Narrative Biography

Biography Autobiography

Autobiography Memoir

Memoir Reference

Reference Encyclopedia

Encyclopedia Christina Klein

Christina Klein Chris Carmichael

Chris Carmichael Christian Wiggins

Christian Wiggins Christy Teglo

Christy Teglo Charlotte Dunford

Charlotte Dunford Chonda Pierce

Chonda Pierce Chrissa Pagitsas

Chrissa Pagitsas Chuck Neighbors

Chuck Neighbors Chip Heath

Chip Heath Cidney Swanson

Cidney Swanson Charles Nordhoff

Charles Nordhoff Christopher C Pollitt

Christopher C Pollitt Chinghua Tang

Chinghua Tang Chris Pallant

Chris Pallant Charles Salzberg

Charles Salzberg Charles Bukowski

Charles Bukowski Christie Matheson

Christie Matheson Christopher S Wren

Christopher S Wren Christopher Harris

Christopher Harris Christina Mcghee

Christina Mcghee

Light bulbAdvertise smarter! Our strategic ad space ensures maximum exposure. Reserve your spot today!

Carlos DrummondDelve into the Shadows of Warhammer Crime: A Review of Bloodlines by Chris...

Carlos DrummondDelve into the Shadows of Warhammer Crime: A Review of Bloodlines by Chris... F. Scott FitzgeraldFollow ·11.8k

F. Scott FitzgeraldFollow ·11.8k Cortez ReedFollow ·18.6k

Cortez ReedFollow ·18.6k Art MitchellFollow ·4k

Art MitchellFollow ·4k Vic ParkerFollow ·13k

Vic ParkerFollow ·13k Ashton ReedFollow ·18.3k

Ashton ReedFollow ·18.3k Neil ParkerFollow ·7.3k

Neil ParkerFollow ·7.3k Sammy PowellFollow ·17.8k

Sammy PowellFollow ·17.8k Ernest PowellFollow ·2.1k

Ernest PowellFollow ·2.1k

J.R.R. Tolkien

J.R.R. TolkienEscape to the Culinary Paradise: "Truck Stop Deluxe In...

Prepare your palate for an...

Andres Carter

Andres CarterA Taste of the Unusual: Discover the Enchanting World of...

Prepare to be captivated by "Cindy Supper...

Nick Turner

Nick TurnerChild Obesity: Introducing the Idea of Healthy Weight

Child obesity is a serious...

Junot Díaz

Junot DíazGoing Local: Your Ultimate Guide to Swiss Schooling |...

In the heart of Europe, Switzerland boasts a...

Raymond Parker

Raymond ParkerSir Cumference and the Dragon of Pi: A Mathematical Fable

In the enchanting realm of...

Thomas Powell

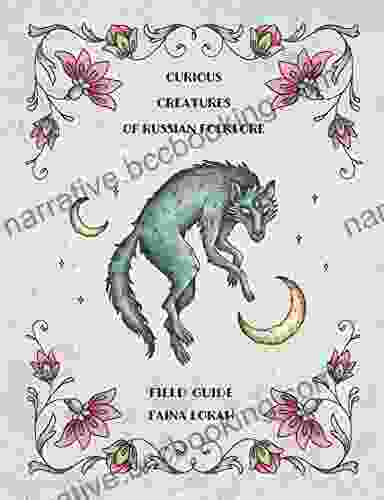

Thomas PowellUnveiling the Enchanting Realm of Curious Creatures from...

Russian folklore is a rich tapestry of...

4.6 out of 5

| Language | : | English |

| File size | : | 2795 KB |

| Text-to-Speech | : | Enabled |

| Screen Reader | : | Supported |

| Enhanced typesetting | : | Enabled |

| Word Wise | : | Enabled |

| Print length | : | 362 pages |